Benefits of E-Invoicing and Who Should Comply

- 12 Nov 25

- 7 mins

Benefits of E-Invoicing and Who Should Comply

- What Is e-invoicing (Electronic Invoice) Under GST?

- Benefits of e-invoicing for Suppliers

- Benefits of e-invoicing for Buyers

- Who Needs to Generate an e-invoice?

- Transactions and Documents Where e-Invoicing Applies

- Who Does Not Have to Comply with e-Invoicing?

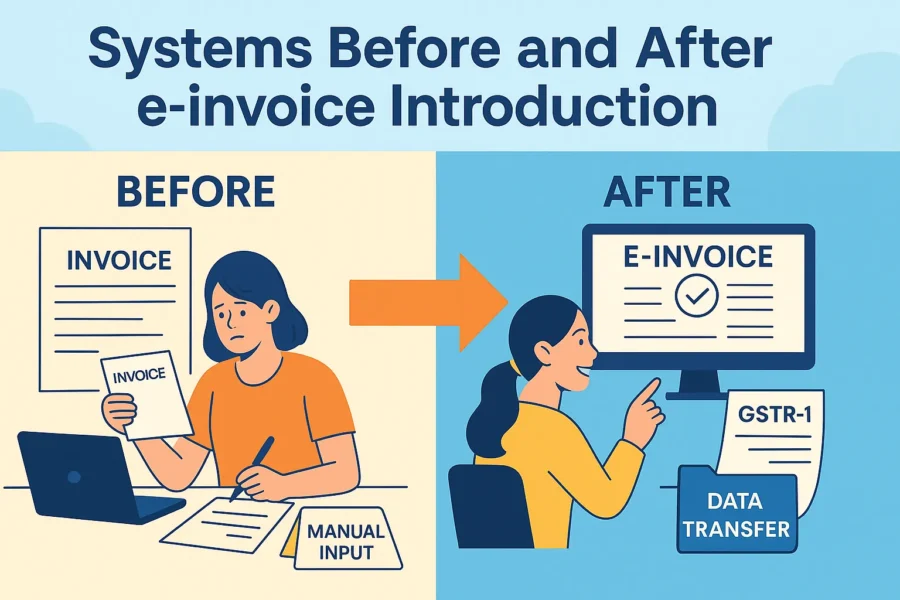

- Systems Before and After e-invoice Introduction

- Deadline for Invoice Processing

- Conclusion

Key Takeaways

- E-invoicing under GST was implemented in April 2025 for businesses with an annual turnover above ₹10 crore.

- The benefits of e invoicing include automation, transparency, and improved compliance for both buyers and suppliers.

- E-invoices are authenticated by the GSTN and automatically shared with the GST and e-way bill portals, reducing manual entry.

- Suppliers enjoy faster payments, better cash flow, and fewer disputes, thanks to digital validation.

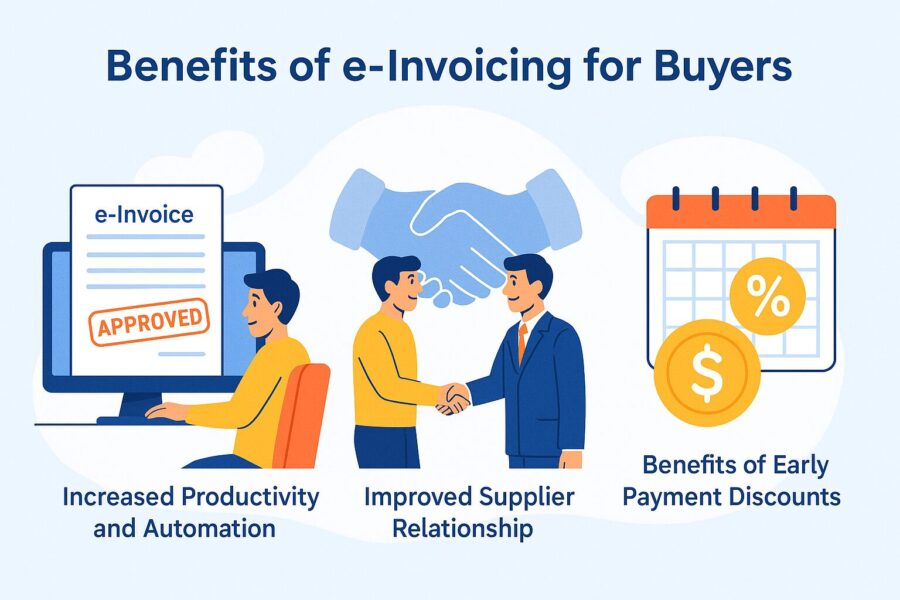

- Buyers gain from higher productivity, early payment discounts, and stronger supplier relationships, highlighting the overall benefits of e invoicing.

While the concept of e-invoicing was declared by the GST authorities in 2023, the same came into effect in April 2025 for taxpayers with a ₹10 crore annual aggregate turnover. E-invoices have multiple benefits, including enhanced customer satisfaction and loyalty. Learn about the benefits of e-invoicing in detail before you proceed to generate or pay an e-invoice amount.

What Is e-invoicing (Electronic Invoice) Under GST?

The GSTN (Goods and Services Tax Network) authenticates B2B invoices using electronic invoicing (e-invoicing) for further use on the unified GST portal. This system of e-invoicing was implemented after the 35th meeting of the GST Council, wherein specific categories of persons were covered, including large enterprises.

Further, mid-sized and small businesses have been included, wherein previously generated invoices are submitted on the GST portal. This e-invoicing process helps automate reporting for various purposes.

The set of common portals required to create e-invoices has been provided as per Notification No. 69/2019 - Central Tax. The Invoice Registration Portal (IRP) issues an identification number for each e-invoice.

From the common portals, information related to e-invoices is transferred to the unified GST portal and e-way bill portal on a real-time basis. This eliminates the need for manual data entry when you file GSTR-1 returns and generate part A of e-way bills.

Benefits of e-invoicing for Suppliers

1. Improved Account Reconciliation

Prior to the introduction of e-invoices, suppliers had to match bank statements and manual invoice information or invoice data to check for discrepancies in manual processing. However, automated software-generated e-invoices (digital invoices and process automation) have eliminated manual calculation, helping in account reconciliation.

2. Improved Cash Flow with Faster Payment

As suppliers can easily send e-invoices to buyers, they can raise payment requests without any delay. Moreover, as there are due dates for raising e-invoices, payments are streamlined with timely receipts. This improves cash flow, helping suppliers estimate their annual budget.

3. Improved Customer Satisfaction

E-invoicing has enhanced transparency between suppliers and consumers with real-time tracking and access to information. The payment system has significantly improved in B2B transactions with PDF invoices. Buyers can access such information, aiding in streamlined customer relationships, which further results in customer satisfaction.

4. Fewer Disputes and Rejected Invoices

As e-invoices are generated with automated systems, it has reduced errors and disputes pertaining to manual invoice matching and preparation. Thus, rejection and disputes in invoices have reduced with the use of e-invoices.

Benefits of e-invoicing for Buyers

1. Increased Productivity and Automation

Buyers or customers can seamlessly get e-invoices approved and paid, as they do not have to put in additional time on data input. This improves their business productivity.

2. Improved Supplier Relationship

As the payment process is automated and streamlined, buyers develop a trustworthy relationship with the suppliers. It results in customer loyalty and supplier retention among buyers.

3. Benefits of Early Payment Discounts

Buyers can enjoy the benefits of an early payment discount by paying the invoice amount before the due date of a payment cycle. This improves the buyer's cash management for transactions.

Who Needs to Generate an e-invoice?

Here is the turnover limit for individuals eligible to generate e-invoices:

| Phase | Applicable to Taxpayers Having an Aggregate Turnover of More Than | Applicable Date | Notification Number |

| I | ₹500 crore | 01.10.2020 | 61/2020 – Central Tax and 70/2020 – Central Tax |

| II | ₹100 crore | 01.01.2021 | 88/2020 - Central Tax |

| III | ₹50 crore | 01.04.2021 | 5/2021 - Central Tax |

| IV | ₹20 crore | 01.04.2022 | 1/2022 - Central Tax |

| V | ₹10 crore | 01.10.2022 | 17/2022 – Central Tax |

| VI | ₹5 crore | 01.08.2023 | 10/2023 - Central Tax |

💡For your bill payments and tracking business transactions, use the PICE App.

Transactions and Documents Where e-Invoicing Applies

E-invoice applies to the following documents:

- Credit notes

- Tax invoices

- Debit notes under Section 34 of the CGST Act (Central Goods and Services Tax Act)

Here is the list of transactions where e-invoices apply:

- Taxable business-to-business sale of services or goods

- Exports

- Business-to-government sale of goods or services

- Deemed exports

- Supplies to SEZ (Special Economic Zone) with or without tax

- Stock transfers

- Supply to distinct persons

- Supplies under the reverse charge mechanism under Section 9(3) of the CGST Act

- SEZ Developers

Who Does Not Have to Comply with e-Invoicing?

Here is the list of individuals or entities who need not comply with e-invoicing:

| Notified Businesses | Documents | Transactions |

| An insurer or a banking company or a financial institution, including an NBFC A registered person supplying passenger transportation services A Goods Transport Agency (GTA) A registered person supplying services by way of admission to the exhibition of cinematographic films in multiplex services A government department and a Local authority (excluded via CBIC Notification No. 23/2021 – Central Tax)An SEZ unit (excluded via CBIC Notification No. 61/2020 – Central Tax) Persons registered in terms of Rule 14 of the CGST Rules (OIDAR) | Delivery challans, financial or commercial credit note or debit note, Bill of supply, Bill of entry and ISD invoices | Any Business-to-Consumers (B2C) sales, nil-rated or non-taxable or exempt B2G sale of goods or services, Nil-rated or non-taxable or exempt B2B sale of goods or services, imports, high sea sales and bonded warehouse sales, supplies under reverse charge covered by Section 9(4) of the CGST Act, and Free Trade & Warehousing Zones (FTWZ) |

Systems Before and After e-invoice Introduction

Prior to e-invoicing, businesses had to generate manual invoices to upload in the GSTR-1 return or use an ERP. Suppliers had to file GSTR-1 returns in order to reflect the data on GSTR-2B of the recipient. Transporters and consignors had to generate e-way bills with the import of data in Excel/JSON files/ERP manually.

With the introduction of the e-invoicing system, the process of invoice uploading has not changed. You need to import using JSON files or Excel or through API integration directly or using the GST Suvidha provider. This helps reflect the data on GSTR-1 without any hassle.

Deadline for Invoice Processing

Before 30th April 2023, there was no specific time limit specified by the GST law to generate e-invoices. However, from 1st May onwards, the GST authorities and the Government declared that taxpayers having an annual aggregate turnover (AATO) exceeding ₹100 crore need to generate e-invoices within 7 days from the invoice date for tax invoices and debit-credit notes.

Nevertheless, the 7-day rule was not implemented. Rather the Government declared that from November 2023 onwards, taxpayers with the mentioned turnover limit need to generate an e-invoice within 30 days from the date of issue of documents.

Further, the 5th November advisory declared that taxpayers with ₹10 crore AATO need to comply with the law. Notably, the changes were deemed to come into effect from 1st April 2025.

Conclusion

The benefits of e-invoicing help both suppliers and customers transact with transparency. Real-time access to information promotes trustworthy relationship development between suppliers and customers. However, whether you are a supplier or a customer, make sure to generate and pay your e-invoices within the stipulated time frame to comply with the GST laws.